Market Update 20250704 GMT+8 8:00am

- Political Developments: President Trump announced a U.S.-Vietnam trade deal on Truth Social, though specifics are pending, boosting market optimism. The Senate passed a tax and spending bill, with Vice President JD Vance breaking a 50-50 tie, which includes scrapping EV tax credits and adding $1 trillion to costs, awaiting House approval. This caused volatility, notably impacting Tesla stock after Elon Musk’s criticism. U.S. prosecutors charged two Chinese nationals as agents of China’s security service, potentially straining U.S.-China trade relations.

- Economic Developments: The ADP report showed a 33,000 private-sector job loss in June, the first since March 2023, pressuring markets. The S&P 500 rose 0.2%, Nasdaq gained 0.7% (led by tech stocks like Nvidia and Apple), and the Dow was up, driven by healthcare (e.g., UnitedHealthcare +4.5%). Centene (CNC) plummeted over 30% after withdrawing 2025 guidance. Markets anticipate a 93.2% chance of a Federal Reserve rate cut in September.

- Forex Impact: The U.S. dollar weakened slightly due to tariff uncertainties and the expected rate cut, with USD under pressure against major currencies like EUR and GBP.

- Commodities Impact: Commodity ETFs saw $6.7 billion in June inflows, with gold gaining as a safe-haven amid trade tensions. Oil prices were volatile due to tariff risks and Middle East stability concerns.

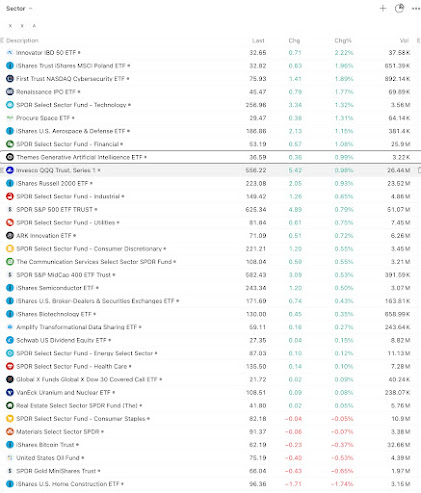

- Thematic ETFs Impact: Defense ETFs (e.g., Themes Transatlantic Defense ETF, NATO) and AI ETFs (e.g., Themes Generative Artificial Intelligence ETF, WISE) rose due to trade deal optimism and tech momentum. Crypto ETFs, like iShares Bitcoin Trust (IBIT) and ETH ETFs, saw inflows, with BlackRock’s Ethereum Trust gaining $40 million.

Europe

- Political Developments: The ECB’s Sintra forum highlighted cautious monetary policy, with ECB President Lagarde’s speech signaling no immediate rate changes. The EU is exploring tariff reductions to align with the Trump administration, easing trade tensions.

- Economic Developments: The FTSE 100 rose 0.2% on July 2, driven by commodity producers and financials, while the STOXX 600 traded cautiously. Eurozone inflation hit the ECB’s 2% target, boosting confidence but not shifting policy.

- Forex Impact: The euro strengthened slightly against the USD (EUR/USD at 1.1733–1.1862) due to stable inflation. GBP/USD faced pressure from UK’s alignment with U.S. policies.

- Commodities Impact: Gold remained a safe-haven asset, while oil and gas flows were stable despite Middle East ceasefire concerns. European commodity markets tracked global trends.

- Thematic ETFs Impact: Defense ETFs (e.g., Select STOXX Europe Aerospace & Defense ETF, EUAD) gained due to NATO spending increases. AI and cybersecurity ETFs saw inflows amid tech optimism.

Japan

- Political Developments: Japan vowed to counter U.S. auto tariffs with domestic producer aid, signaling proactive trade policy. BOJ Governor Ueda’s speech on July 1 was anticipated to clarify monetary tightening, affecting market sentiment.

- Economic Developments: No specific updates for July 2–3, but on June 30, the Nikkei 225 fell 0.13% and Topix dropped 0.36%, reflecting caution over BOJ tightening and yen strength impacting exports.

- Forex Impact: The yen weakened to 146.52 against the USD on June 30, with further softening possible if BOJ signals gradual tightening. USD/JPY traded at 143.18–144.22.

- Commodities Impact: Japan’s reliance on energy imports made it sensitive to oil price volatility, driven by global tariff risks and Middle East dynamics.

- Thematic ETFs Impact: Defense and industrial ETFs tied to Japan’s Indo-Pacific strategy (ex-China) saw interest. Technology ETFs remained appealing amid global AI trends.

China

- Political Developments: China eased outbound investment controls, signaling relaxed capital policies. U.S. charges against Chinese nationals for espionage could escalate trade tensions, impacting investor confidence.

- Economic Developments: On June 30, the Shanghai Composite (+0.59%), Shenzhen Component (+0.83%), CSI 300 (+0.37%), and ChiNext (+1.35%) rose, while the Hang Seng fell 0.87%. June factory activity increased, supporting sentiment.

- Forex Impact: The offshore yuan depreciated 0.15% to 7.1883 against the USD on June 30, with further pressure from U.S. tariff risks and economic slowdown.

- Commodities Impact: China’s demand influenced global commodity cycles, particularly metals and energy. The Australian dollar (AUD) was affected due to trade linkages.

- Thematic ETFs Impact: Emerging markets ex-China ETFs (e.g., iShares MSCI Emerging Markets ex China ETF, EMXC, $13 billion in assets) saw inflows due to caution over China’s economic outlook.

Traditional Chinese: 市場新聞(過去24小時,截至2025年7月3日上午08:01 +08)

美國

- 政治動態:特朗普總統在Truth Social上宣布與越南達成貿易協議(細節待公布),提振市場樂觀情緒。參議院通過稅收與支出法案,副總統JD萬斯打破50-50平局,法案取消電動車稅收抵免並增加1萬億美元成本,待眾議院批准。該法案引發波動,特斯拉股票因馬斯克批評而受影響。美國檢方指控兩名中國公民為中國安全部門代理人,可能加劇美中貿易緊張。

- 經濟動態:ADP報告顯示6月私營部門就業減少33,000個,為2023年3月以來首次,市場承壓。標普500上漲0.2%,納斯達克上漲0.7%(科技股如英偉達、蘋果領漲),道瓊斯指數上漲,醫療保健股(如聯合健康+4.5%)表現強勁。Centene (CNC) 因撤回2025年指引暴跌逾30%。市場預計聯儲會9月降息機率為93.2%。

- 外匯影響:美元因關稅不確定性和降息預期略有走弱,兌主要貨幣如歐元和英鎊承壓。

- 商品影響:6月商品ETF流入67億美元,黃金因貿易緊張成為避險資產。油價因關稅風險和中東穩定性問題波動。

- 主題ETF影響:國防ETF(如Themes Transatlantic Defense ETF, NATO)和人工智能ETF(如Themes Generative Artificial Intelligence ETF, WISE)因貿易協議樂觀情緒和科技動能上漲。加密貨幣ETF,如iShares Bitcoin Trust (IBIT)和以太坊ETF,見流入,貝萊德以太坊信託流入4000萬美元。

歐洲

- 政治動態:歐洲央行辛特拉論壇強調謹慎貨幣政策,行長拉加德講話顯示短期內無利率變化。歐盟考慮降低關稅以配合特朗普政府,緩解貿易緊張。

- 經濟動態:7月2日,富時100指數上漲0.2%,受商品生產商和金融股推動,STOXX 600交易謹慎。歐元區通脹達到歐洲央行2%目標,提振信心但未改變政策。

- 外匯影響:歐元兌美元略升(EUR/USD為1.1733–1.1862),因通脹穩定。英鎊/美元因英國與美國政策一致而承壓。

- 商品影響:黃金為避險資產,油氣供應雖受中東停火疑慮影響仍穩定。歐洲商品市場跟隨全球趨勢。

- 主題ETF影響:國防ETF(如Select STOXX Europe Aerospace & Defense ETF, EUAD)因北約防務支出增加而受青睞。人工智能和網絡安全ETF因科技樂觀情緒吸引資金。

日本

- 政治動態:日本承諾以國內生產商援助應對美國汽車關稅,顯示積極貿易政策。日本央行行長植田和夫7月1日講話預計將澄清貨幣收緊政策,影響市場情緒。

- 經濟動態:7月2–3日無具體更新,但6月30日日經225指數跌0.13%,東證指數跌0.36%,反映對日本央行收緊政策和日元走強影響出口的謹慎情緒。

- 外匯影響:6月30日日元兌美元貶值至146.52,若日本央行逐步收緊政策,可能進一步走弱。美元/日元交易於143.18–144.22。

- 商品影響:日本依賴能源進口,油價因全球關稅風險和中東動態波動。

- 主題ETF影響:與日本印太戰略(除中國外)相關的國防和工業ETF受到關注。科技ETF因全球人工智能趨勢保持吸引力。

中國

- 政治動態:中國放寬境外投資限制,顯示資本政策放鬆。美國對中國公民的間諜指控可能加劇貿易緊張,影響投資者信心。

- 經濟動態:6月30日,上海綜合指數上漲0.59%、深圳成份指數上漲0.83%、滬深300上漲0.37%、創業板上漲1.35%,恆生指數下跌0.87%。6月工廠活動增加,支撐市場情緒。

- 外匯影響:6月30日離岸人民幣兌美元貶值0.15%至7.1883,受美國關稅風險和經濟放緩壓力。

- 商品影響:中國需求影響全球金屬和能源週期,澳元因貿易聯繫受影響。

- 主題ETF影響:新興市場除中國ETF(如iShares MSCI Emerging Markets ex China ETF, EMXC,資產130億美元)因對中國經濟前景的謹慎而吸引資金。

Comments