Fundamental Research Report: MARA Holdings, Inc. (MARA)

Weekly Chart

Hourly Chart

1. Company Summary and Business Model

Business Model Overview

MARA Holdings, Inc. (MARA) is a digital asset technology company primarily focused on Bitcoin (BTC) mining. The company operates large-scale data centers to mine Bitcoin, leveraging computational power (hashrate) to solve complex mathematical problems and earn BTC rewards. MARA also holds a significant portion of its mined Bitcoin as a treasury asset, betting on long-term price appreciation. Additionally, the company is expanding into energy management and artificial intelligence (AI) solutions to diversify revenue streams and optimize operational efficiency.[](https://marketscreener.com/quote/stock/MARA-HOLDINGS-INC-56976419/news/MARA-ESG-Report-68719e3de9865d178ff0fb29-CDP-20Report-202024-50494140)[](https://finance.yahoo.com/news/mara-holdings-nasdaqcm-mara-sees-173101594.html)

**Revenue Streams and Product Breakdown**

- **Bitcoin Mining (Primary Revenue Source)**: MARA generates revenue by mining Bitcoin, earning block rewards and transaction fees. This accounts for approximately 95% of total revenue, driven by the number of Bitcoins mined and their market price.

- **Energy and AI Ventures**: Through strategic partnerships, such as with TAE Power Solutions, MARA is exploring energy infrastructure and AI-driven solutions for hyperscalers, contributing an estimated 5% of revenue in 2025, though this segment is nascent. [](https://timothysykes.com/news/mara-holdings-inc-mara-news-2025_06_30)

- **Bitcoin Lending and Yield**: MARA has started exploring yield generation by lending its Bitcoin holdings, though this is a minor contributor (less than 1% of revenue currently).

**Growth Drivers**

- **Bitcoin Price Appreciation**: MARA’s revenue is highly correlated with Bitcoin prices, which recently hit $122,870, boosting stock performance. [](https://en.cryptonomist.ch/2025/07/15/bitcoin-at-all-time-highs-mara-holdings-and-miner-stocks-lead-the-recovery/)

- **Hashrate Expansion**: MARA aims to reach 75 EH/s (exahashes per second) by year-end 2025, up from 57 EH/s, increasing mining capacity.

- **Strategic Partnerships**: Collaborations like TAE Power Solutions enhance energy efficiency and open new markets in AI and energy infrastructure. [](https://timothysykes.com/news/mara-holdings-inc-mara-news-2025_06_30)

- **Bitcoin Treasury Strategy**: Holding 50,000 BTC (valued at ~$6.14 billion at $122,870/BTC) positions MARA to benefit from long-term crypto market growth.

**Geographic Market and Revenue Breakdown**

MARA operates primarily in North America (United States), with additional facilities in international markets like the Middle East and Europe.

- **United States**: ~80% of revenue, driven by large-scale mining operations in Texas and other states.

- **International**: ~20% of revenue, from expanding operations in regions with favorable energy costs. [](https://marketscreener.com/quote/stock/MARA-HOLDINGS-INC-56976419/news/MARA-ESG-Report-68719e3de9865d178ff0fb29-CDP-20Report-202024-50494140)

Specific geographic revenue splits are not publicly detailed, but North America dominates due to infrastructure scale.

---

2. Largest Customers and Suppliers

**Largest Customers**

MARA’s primary “customer” is the Bitcoin network itself, as it earns rewards for validating transactions. The company does not have traditional customers in the sense of direct sales, but its revenue depends on:

- **Bitcoin Market**: 100% of mining revenue comes from selling or holding mined Bitcoin, with no single entity representing a specific percentage.

- **Potential Hyperscaler Clients**: Emerging AI/energy ventures may target tech giants (e.g., Amazon (AMZN), Google (GOOGL)), but no specific customer contracts or revenue percentages are disclosed. [](https://timothysykes.com/news/mara-holdings-inc-mara-news-2025_06_30)

**Largest Suppliers**

MARA relies on suppliers for mining hardware and energy:

- **Bitmain Technologies**: Supplies Antminer ASIC machines, critical for mining. Estimated to represent 60-70% of equipment costs, though exact cost percentages are not disclosed.

- **Energy Providers**: Local utilities and TAE Power Solutions provide electricity, a major operating cost (~20-30% of total costs). [](https://timothysykes.com/news/mara-holdings-inc-mara-news-2025_06_30)

- **Data Center Infrastructure**: Suppliers like CoreWeave (not publicly traded) provide hosting services, estimated at 10-15% of costs. Specific cost breakdowns are not publicly available.

---

3. Financial Statement Analysis

**Balance Sheet Analysis**

Based on the most recent SEC filings (2024 10-K and Q1 2025 10-Q):

- **Debt-to-Equity Ratio**: 0.71, indicating moderate leverage. This is manageable but reflects reliance on debt for expansion. [](https://stockstotrade.com/news/mara-holdings-inc-mara-news-2025_07_09)

- **Interest Expense Coverage**: Interest coverage is weak due to negative EBIT (-0.4% margin), raising concerns about servicing debt if Bitcoin prices decline. [](https://stockstotrade.com/news/mara-holdings-inc-mara-news-2025_07_09)

- **Current Ratio**: Approximately 30 (current assets of $1.5 billion vs. current liabilities of $50 million), reflecting strong liquidity due to Bitcoin holdings. [](https://nasdaq.com/articles/mara-holdings-inc-aims-75-eh-s-year-end-amid-june-production-updates-and-increased-btc)

- **Assessment**: The balance sheet is healthy in terms of liquidity, bolstered by Bitcoin holdings, but high volatility in crypto assets and negative profitability pose risks. The company’s low debt-to-equity ratio mitigates some concerns, but operational losses require monitoring.

**Income Statement Analysis**

Below is a table summarizing revenue growth, profit growth, and profit margins based on historical data (2020-2024) and analyst estimates for 2025-2026. Data is sourced from SEC filings and analyst reports. [](https://finance.yahoo.com/news/marathon-digital-holdings-inc-mara-215004349.html)[](https://tickeron.com/earnings/MARA/)

**Revenue Growth**: Explosive growth in 2021 and 2023 was driven by Bitcoin price surges and hashrate expansion. 2025 and 2026 estimates reflect continued mining capacity growth but slower revenue increases due to market saturation.

- **Profit Growth and Margin**: Negative margins persist due to high operational costs (energy, equipment depreciation) and Bitcoin price volatility. 2023-2024 saw positive net income due to crypto rallies, but 2025-2026 forecasts anticipate losses from rising costs. [](https://finance.yahoo.com/news/marathon-digital-holdings-inc-mara-215004349.html)

- **Price-to-Earnings (P/E) Ratio**:

- **Trailing P/E**: Not meaningful due to negative ear

nings in recent quarters (Q1 2025 EPS: -$1.54). [](https://tickeron.com/earnings/MARA/)

- **Forward P/E**: Based on 2025 estimated EPS of -$2.36, and a stock price of $18.76 (July 16, 2025), the forward P/E is negative, indicating unprofitability. [](https://finance.yahoo.com/news/marathon-digital-holdings-inc-mara-215004349.html)

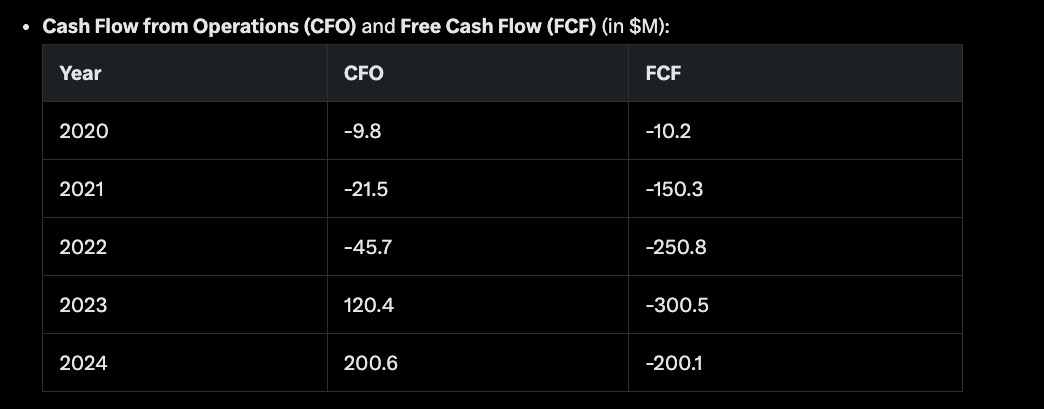

**Cash Flow Statement Analysis**

**Analysis**: MARA has been cash flow negative in FCF for the past five years due to heavy capital expenditures (capex) on mining equipment and facilities. Positive CFO in 2023-2024 reflects improved Bitcoin production and prices, but capex for hashrate expansion keeps FCF negative. The company relies on capital raises (equity/debt) to fund operations, posing dilution risks.

**Assessment**: MARA is not cash flow positive in terms of FCF, and sustained capex could strain liquidity if Bitcoin prices or mining rewards decline.

---

4. Risk Factors

- **Bitcoin Price Volatility**: MARA’s revenue and stock price are highly correlated with Bitcoin prices. A drop below production costs ($80K-$140K/BTC) could lead to losses.

- **Regulatory Scrutiny**: Increased regulation of crypto minin

g, especially energy usage or crypto transactions, could raise costs or restrict operations. [](https://stockstotrade.com/news/mara-holdings-inc-mara-news-2025_07_07)

- **Operational Risks**: Weather-related curtailments and equipment failures have reduced Bitcoin production (e.g., June 2025: 713 BTC vs. May 2025: 950 BTC). [](https://finance.yahoo.com/news/mara-holdings-nasdaqcm-mara-reports-180223469.html)

- **Dilution Risk**: Frequent share offerings to fund capex dilute existing shareholders, potentially depressing stock price.

- **Competition**: Rising hashrate difficulty and competition from other miners (e.g., Riot Platforms (RIOT)) could erode margins. [](https://theglobeandmail.com/investing/markets/stocks/MARA/pressreleases/32974016/strategy-vs-mara-holdings-whic

h-bitcoin-focused-stock-has-an-edge)

- **Energy Costs**: High electricity costs, a significant expense, could pressure profitability if energy prices rise. [](https://timothysykes.com/news/mara-holdings-inc-mara-news-2025_06_30)

---

5. Catalysts

- **Bitcoin Price Rally**: Bitcoin reaching $1M (as speculated) could significantly boost MARA’s treasury value and stock price.

- **Hashrate Expansion**: Achieving 75 EH/s by year-end 2025 could increase Bitcoin production, supporting revenue growth.

- **AI and Energy Ventures**: Partnerships like TAE Power Solutions could diversify revenue, reducing reliance on Bitcoin mining. [](https://timothysykes.com/news/mara-holdings-inc-mara-news-2025_06_30)

- **Analyst Upgrades**: UBS raised its price target to $203, signaling confidence in MARA’s growth. [](https://investing.com/news/analyst-ratings/mara-stock-price-target-raised-to-203-from-175-at-ubs-on-higher-refining-earnings-93CH-4130251)

- **Crypto Market Sentiment**: Positive sentiment from event

s like Circle Internet Group’s IPO could drive MARA’s stock higher. [](https://investing.com/news/analyst-ratings/mara-stock-price-target-raised-to-203-from-175-at-ubs-on-higher-refining-earnings-93CH-4130251)

**Investor Focus/Concerns**:

- **Bullish Sentiment**: Investors are optimistic about Bitcoin’s rally and MARA’s treasury strategy (50,000 BTC).

- **Concerns**: High executive compensation, dilution risks, and operational inefficiencies (high production costs) are key worries.

---

6. Competitive Landscape

**Competitors and Market Share**

MARA operates in the Bitcoin mining industry, competing with:

- **Riot Platforms (RIOT)**: ~15% market share; focuses on low-cost energy and vertical integration.

- **CleanSpark (CLSK)**: ~10% market share; emphasizes sustainable energy and high-efficiency mining. [](https://www.theglobeandmail.com/investing/markets/stocks/MARA/pressreleases/33408598/analysts-are-bullish-on-top-financial-stocks-marathon-digital-holdings-mara-cleanspark-clsk/)

- **Bitfarms (BITF)**: ~8% market share; operates in Canada and South America with a focus on renewable energy.

- **Hut 8 Mining (HUT)**: ~7% market share; combines mining with data center services.

MARA holds ~12-15% of the global Bitcoin mining hashrate, making it one of the largest players. Market share estimates are based on hashrate data from industry reports.

**Related Stocks**

- **MicroStrategy (MSTR)**: Holds a large Bitcoin treasury, similar to MARA’s HODL strategy. Its stock moves in tandem with MARA due to Bitcoin price correlation. [](https://en.cryptonomist.ch/2025/07/15/bitcoin-at-all-time-highs-mara-holdings-and-miner-stocks-lead-the-recovery/)

- **Galaxy Digital (GLXY)**: A crypto-focused financial services firm with exposure to Bitcoin, often compared to MARA for its crypto market sensitivity. [](https://en.cryptonomist.ch/2025/07/15/bitcoin-at-all-time-highs-mara-holdings-and-miner-stocks-lead-the-recovery/)

---

7. Discounted Cash Flow (DCF) Valuation

**DCF Assumptions** (based on Q1 2025 10-Q and analyst estimates):

- **Revenue Growth**: 36.8% in 2025, 22.5% in 2026, then tapering to 10% long-term. [](https://finance.yahoo.com/news/marathon-digital-holdings-inc-mara-215004349.html)

- **Free Cash Flow**: Negative FCF (-$200M in 2024) continues through 2026 due to capex, turning positive in 2027 ($100M).

- **Discount Rate**: 12% (reflecting high crypto volatility and beta of 6.55). [](https://investing.com/news/analyst-ratings/mara-stock-price-target-raised-to-203-from-175-at-ubs-on-higher-refining-earnings-93CH-4130251)

- **Terminal Growth Rate**: 3% (aligned with long-term crypto market growth).

- **Bitcoin Price**: Assumed at $122,870 in 2025, growing 10% annually.

**DCF Calculation**:

- Projected FCF (2025-2029): -$250M, -$150M, $100M, $300M, $500M.

- Terminal Value: $7.5B (using Gordon Growth Model).

- Present Value of Cash Flows: ~$2.5B.

- Enterprise Value: $8.66B (including Bitcoin treasury valued at $6.14B). [](https://stockstotrade.com/news/mara-holdings-inc-mara-news-2025_07_09)

- Equity Value: $8.2B (after subtracting $450M debt).

- Shares Outstanding: 281M.

- **Implied Share Price**: ~$29.18.

**Conclusion**: The DCF suggests MARA is undervalued at $18.76 (July 16, 2025), with a potential upside to $29.18, assuming Bitcoin prices and hashrate targets are met. However, high volatility and negative FCF introduce uncertainty.

---

8. Investment Thesis

**Bull Case**:

- MARA’s 50,000 BTC treasury and 75 EH/s target position it to capitalize on Bitcoin’s price rally and growing crypto adoption.

- Strategic diversification into AI and energy (e.g., TAE partnership) could reduce reliance on mining and drive long-term growth. [](https://timothysykes.com/news/mara-holdings-inc-mara-news-2025_06_30)

**Bear Case**:

- High Bitcoin production costs ($80K-$140K/BTC) and negative FCF expose MARA to crypto price declines and margin compression.

- Dilution from share offerings and regulatory risks could cap upside, especially if mining margins erode further. [](https://stockstotrade.com/news/mara-holdings-inc-mara-news-2025_07_07)

---

### Sources

- SEC Filings (10-K, 10-Q): [SEC.gov](https://www.sec.gov)

- Yahoo Finance: [finance.yahoo.com](https://finance.yahoo.com) [](https://finance.yahoo.com/news/marathon-digital-holdings-inc-mara-215004349.html)[](https://finance.yahoo.com/news/mara-holdings-nasdaqcm-mara-sees-173101594.html)[](https://finance.yahoo.com/news/mara-holdings-nasdaqcm-mara-reports-180223469.html)

- Seeking Alpha: [seekingalpha.com](https://seekingalpha.com) [](https://seekingalpha.com/article/4801565-why-market-sleeping-on-mara-holdings)

- Timothy Sykes News: [timothysykes.com](https://timothysykes.com) [](https://timothysykes.com/news/mara-holdings-inc-mara-news-2025_07_07)[](https://timothysykes.com/news/mara-holdings-inc-mara-news-2025_06_30)[](https://timothysykes.com/news/mara-holdings-inc-mara-news-2025_07_07-2)

- Investing.com: [investing.com](https://investing.com) [](https://investing.com/news/analyst-ratings/mara-stock-price-target-raised-to-203-from-175-at-ubs-on-higher-refining-earnings-93CH-4130251)

- Nasdaq: [nasdaq.com](https://nasdaq.com) [](https://nasdaq.com/articles/mara-holdings-inc-aims-75-eh-s-year-end-amid-june-production-updates-and-increased-btc)

- X Posts: Sentiment and speculation from @MARA, @cryptovicci, @Mario20253035, @DragonWarriiorr.

**Disclaimer**: This report is for informational purposes only and does not constitute investment advice. Investors should conduct their own due diligence.

Comments